Add a New Supplier

This guide walks you through the steps to add a new supplier in the Spothire dashboard. Follow these steps to ensure that all necessary information is correctly entered.

Steps to Add a New Supplier

-

Navigate to the Suppliers Dashboard

- Log in to the Spothire dashboard.

- Go to Masters.

- Under Masters, select Suppliers

-

Open the Add Supplier Form

- Click on the + Add Supplier button to open the form to fill the supplier details.

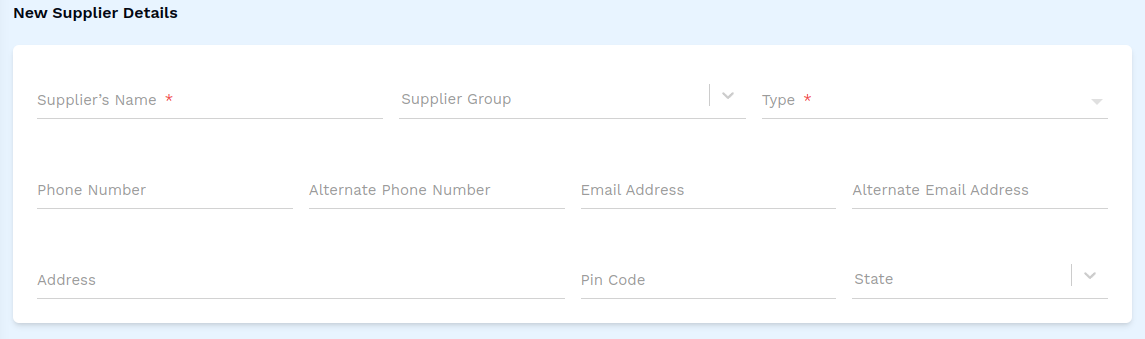

1. Fill in New Supplier Details

- Supplier's Name: Enter the full name of the supplier (required field).

- Supplier Group: Select the appropriate group for the supplier from the dropdown.

- Type: Select a relevant Type for the supplier from the dropdown (required field).

- Phone Number: Enter the supplier’s primary phone number.

- Alternate Phone Number: Add an alternate phone number, if available.

- Email Address: Enter the supplier’s email address.

- Alternate Email Address: Add an alternate email, if available.

- Address: Enter the supplier’s address.

- Pin Code: Enter the pin code for the supplier's location.

- State: Select the state from the dropdown.

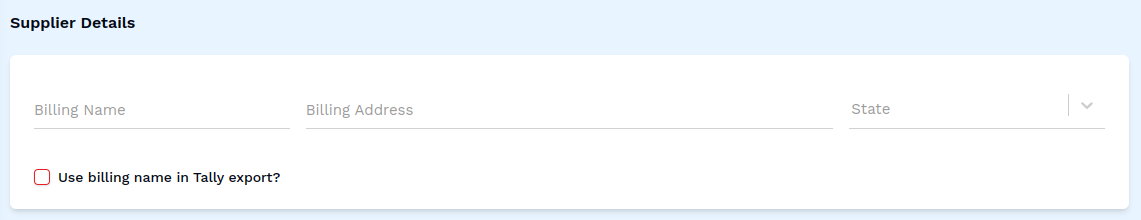

2. Fill in additional Supplier Details

- Billing Name: Enter the name for billing purposes.

- Billing Address: Enter the billing address.

- State: Select the state for billing purposes.

- Use Billing Name in Tally Export?: Check this box if you want the billing name to appear in Tally exports.

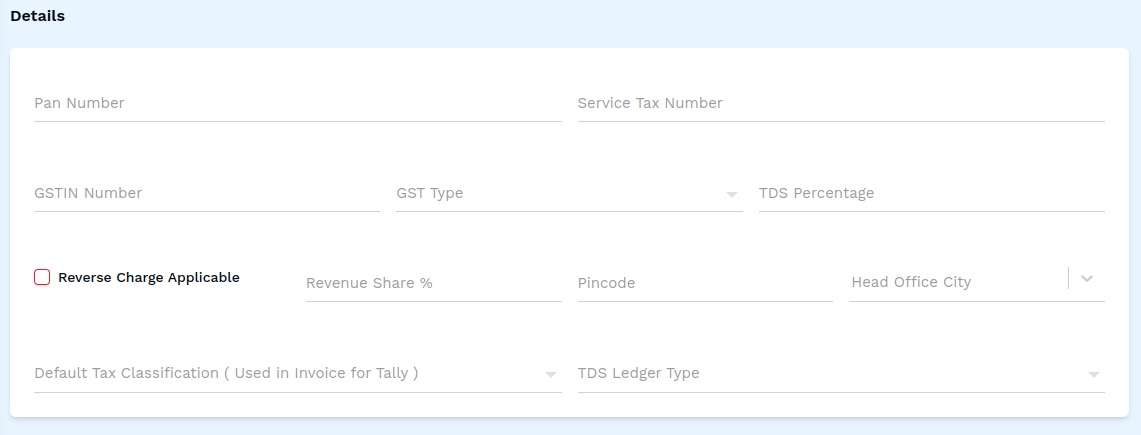

3. Fill in Tax Details

- Pan Number: Enter the supplier’s PAN number.

- Service Tax Number: Enter the service tax number.

- GSTIN Number: Enter the GSTIN number.

- GST Type: Select the GST type from the dropdown.

- TDS Percentage: Enter the TDS percentage.

- Reverse Charge Applicable: Check this box if reverse charge applies.

- Revenue Share %: Enter the percentage of revenue share.

- Pincode: Enter a pincode.

- Head Office City: Select the city in which the supplier's head office is located, from the dropdown.

- Default Tax Classification (Used in Invoice for Tally): Select the tax classification for Tally invoices.

- TDS Ledger Type: Select the type of TDS Ledger.

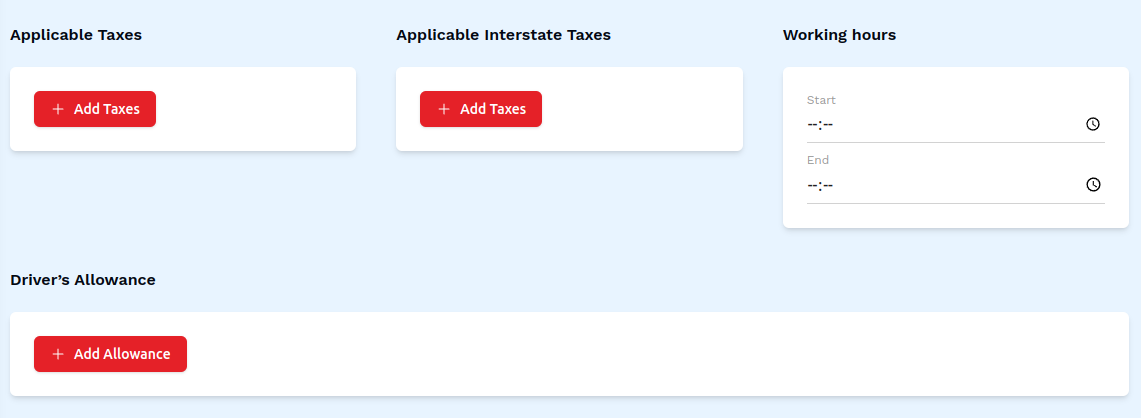

4. Applicable Taxes and Allowances

- Applicable Taxes: Click Add Taxes to select taxes from the dropdown.

- Applicable Interstate Taxes: Click Add Taxes to select interstate taxes from the dropdown.

- Working Hours: Select a Start and End time by clicking on their respective clock icons.

- Driver's Allowance: Click Add Driver Allowance to define allowances for drivers.

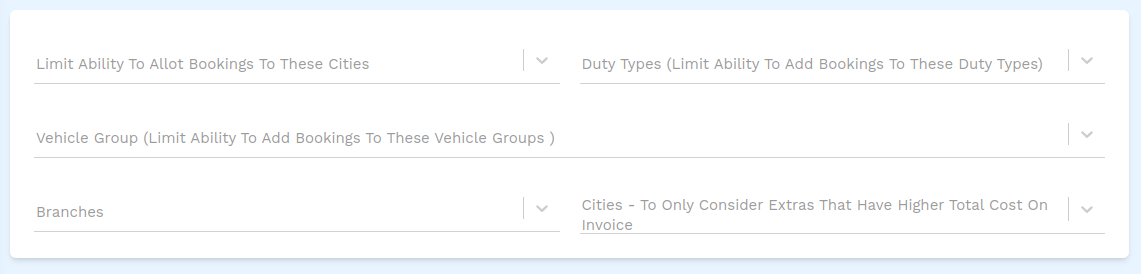

5. Limits

- Limit Ability To Allot Bookings To These Cities: Select one or more cities from the dropdown to limit the ability to allot bookings to only these cities.

- Duty Types (Limit Ability To Add Bookings To These Duty Types): Select one or more duties from the dropdown to limit the ability to allot bookings to only these duty types.

- Vehicle Group (Limit Ability To Add Bookings To These Vehicle Groups): Select one or more vehicle groups from the dropdown to limit the ability to allot bookings to only these vehicle groups.

- Branches: Select one or more branches from the dropdown.

- Cities: Select one or more cities to be considered as extras that have a higher total cost on the invoice.

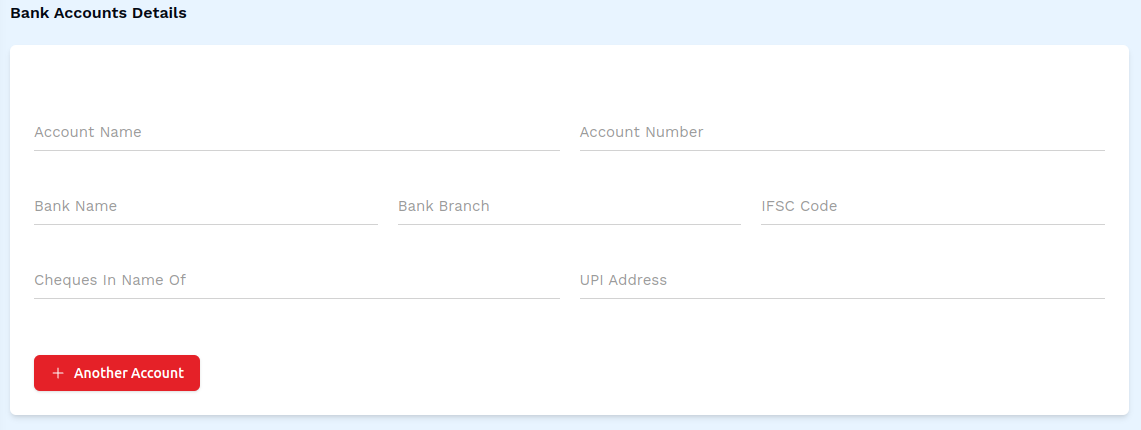

6. Steps to Add Bank Account Details

-

Open the Bank Account Detail form

- Click the + Another Account button

-

Fill in the Bank Account Details

- Account Name: Enter the name of the bank account holder.

- Account Number: Enter the bank account number.

- Bank Name: Enter the name of the bank.

- Bank Branch: Enter the branch name of the bank.

- IFSC Code: Enter the IFSC Code of the bank account.

- Cheques In Name Of: Enter the name of the person that will receive the cheque.

- UPI Address: Enter the UPI Address of the bank account.

7. Files

- Add File: This button will open up a box allowing you to browse and select a file from your computer's local storage.

8. Save the Supplier

- After entering all details, click on the Save button to finalize the supplier entry.

This completes the process of adding a new supplier. Make sure all mandatory fields are filled and correct before saving the information.